Correcting a Duplicate Employee Record

WARNING: PrismHR strongly advises you to test this in your Demo account before performing these tasks in your Live account.

If an employee is entered twice with two different Social Security numbers (SSNs), two different sets of records for that employee exist in the system. If the system pays the employee under both SSNs, you must transfer the information from the incorrect record to the correct record to ensure that only one Form W-2 generates.

Terminating Employee Record with Incorrect SSN

First, you must terminate the incorrect employee on the Employee Termination form.

To terminate the incorrect employee, do the following:

| 1. | Click the menu. |

| 2. | From HR|Action, select Employee Termination. The Employee Termination form opens. |

| 3. | Complete the following: |

|

Use this option |

To do this |

|---|---|

|

Employee ID |

Enter the employee ID with the incorrect SSN (required). |

|

Termination Status Code |

Select a termination status code. |

|

Reason Code |

Select a reason code (required). |

|

Termination Date |

Select the termination date (required). |

|

Termination Explanation |

Enter an explanation for the termination. For example, Incorrect SSN. |

| 4. | Click Save. |

Editing the Terminated Employee Record

After terminating the employee record with the incorrect SSN, you can edit the terminated employee SSN on the Employee Details form.

To edit the employee SSN, do the following:

| 1. | Click the menu. |

| 2. | From HR|Change, select Employee Details. The Employee Details form opens. |

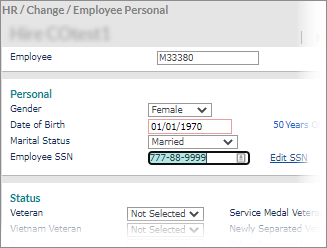

| 3. | Click the Personal tab. |

| 4. | In the Personal panel, click Edit SSN. Enter a unique SSN that differs from the correct employee record. For example, 777-88-9999. |

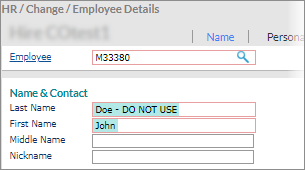

| 5. | Click the Name tab. |

| 6. | To prevent anyone from using the employee record, edit the employee name so users know it is not a valid employee record. For example, John Doe - DO NOT USE. |

| 7. | Click Save. |

If the employee was paid under the incorrect SSN, you must transfer the tax amounts to the correct employee record. To transfer the tax amounts, subtract the taxes from the incorrect tax register and add them to the correct tax register. First, you must obtain the employee and employer tax totals for the employee paid under the incorrect SSN.

Obtaining Tax Totals for Tax Adjustments

You can find the employee and employer tax totals for the employee paid under the incorrect SSN on the Payroll Voucher form.

To obtain tax totals for tax adjustments, do the following:

| 1. | Click the menu. |

| 2. | From Payroll|View, select Payroll Voucher. The Payroll Voucher form opens. |

| 3. | Select the correct Voucher Number, then click the Tax tab. Make note of the information in the Employee Tax and Employer Tax panels. |

After obtaining the employee and employer tax totals, you can adjust the taxes.

Adjusting Taxes

With the employee and employer tax totals for the employee paid under the incorrect SSN, you can make a tax adjustment on the Tax Adjustment form.

To make tax adjustments for the employee paid with the incorrect SSN, do the following:

| 1. | Click the menu. |

| 2. | From Payroll|Change, select Tax Adjustment. The Tax Adjustment form opens. |

| 3. | Enter the Employee ID, Adjustment Date, Employer, and negative amount for taxes. |

If you do not want to bill the client for the tax adjustment, enable Suppress Billing. If disabled, the system bills the client for the adjustment and updates the billing registers. Then, you must enter both the employee and employer tax withholdings.

| 4. | Click Save. |

To make tax adjustments for the employee with the correct SSN, do the following:

| 1. | Click the menu. |

| 2. | From Payroll|Change, select Tax Adjustment. The Tax Adjustment form opens. |

| 3. | Click New adjustment. |

| 4. | Enter the Employee ID, Adjustment Date, Employer, and a positive amount for taxes. |

If you do not want to bill the client for the tax adjustment, enable Suppress Billing. If disabled, the system bills the client for the adjustment and updates the billing registers. Then, you must enter both the employee and employer tax withholdings.

| 5. | Click Save. The system displays a dialog box asking if you want to print a refund check now, of if you want to update scheduled payments and reimburse next pay period. Click No. |

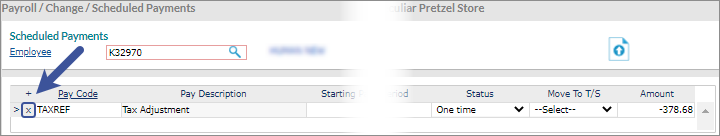

After clicking No, you can go to the Scheduled Payments form to delete the tax refund for both the incorrect and correct employee record.

Deleting Tax Refunds

To delete the tax refund for both the incorrect and correct employee record, use the Scheduled Payments form.

To delete the tax refunds, do the following:

| 1. | Click the menu. |

| 2. | From Payroll|Change, select Scheduled Payments. The Scheduled Payments form opens. |

| 3. | Enter the Employee ID. |

| 4. | Delete the tax refund from the grid. |

| 5. | Click Save. |

After deleting the tax refunds from the system, you can use the Employee Tax Summary form to verify the taxable earnings and tax amounts for the incorrect and correct employee.

Verifying Taxes Adjusted Correctly

To verify the taxable earnings and tax amounts for the incorrect and correct employee, use the Employee Tax Summary form.

To verify the tax information, do the following:

| 1. | Click |

| 2. | From Employer|View, select Employee Tax Summary. The Employee Tax Summary form opens. |

| 3. | Enter the incorrect Employee ID and Year. (No data displays.) |

| 4. | Enter the correct Employee ID and Year. The amounts should reflect the tax adjustment and any wages paid under the correct employee ID. |

Both employees have adjustment vouchers in their history explaining the pay and tax adjustments.

If you do not want to perform a tax adjustment to correct the paid wages and taxes, you can void payroll vouchers for the incorrect SSN and then calculate and post the pay for the correct SSN. Things to consider:

| • | You can post pay by pay date or by quarter. |

| • | Do not to enter pay that crosses from one quarter to the next. |

| • | Before processing your ACH file, remove any ACH entries for crediting and debiting the employee and client. |