Blocking and Suppressing Taxes

There are several ways to block or suppress taxes. For example, you may want to block a local tax. You may also have taxable wages, but no tax.

Resolution or Workaround

Blocking a Tax

There are several ways to block taxes. When you block taxes, the wages will still accrue, but the tax calculation will be blocked.

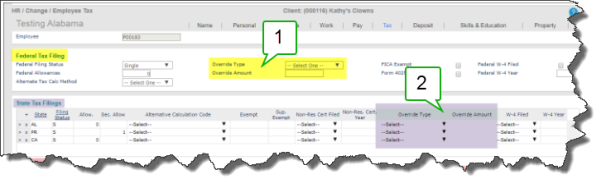

| • | Open the Tax tab on Employee Details (found in the menu under HR|Change). |

| • | You can override for Federal Income Tax in the yellow highlighted section. In the Override Type drop-down, select Block Withholding. |

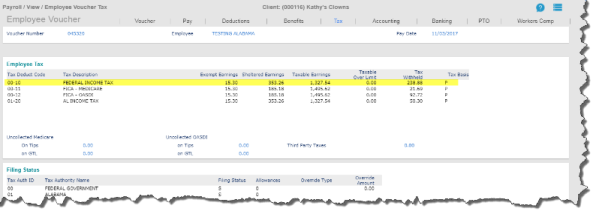

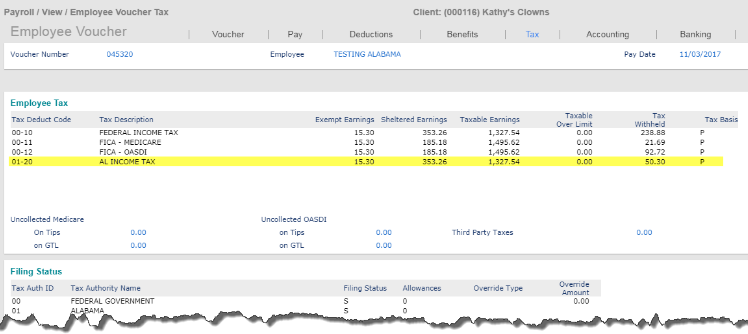

In the following example, the employee's Federal Income Tax calculation is $238.88.

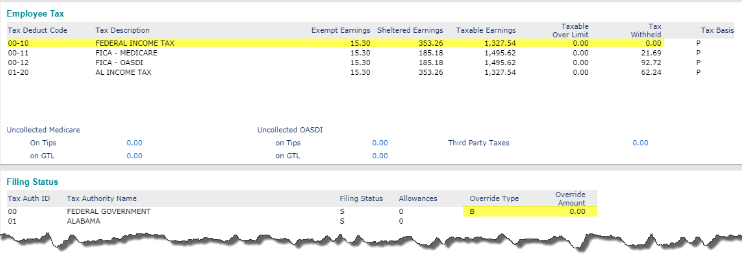

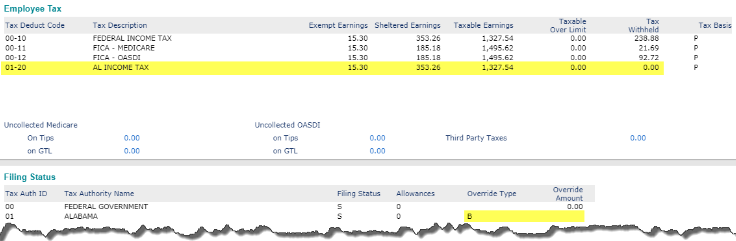

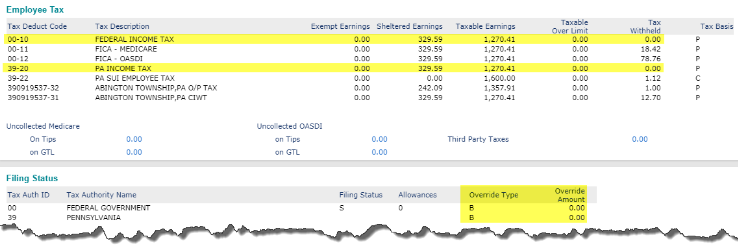

The Block Withholding option allows you to block calculated tax. Wages will still accrue. For example, if you have requested to block the tax, then the amount withheld will be $0.00. The override is denoted in the Filing Status panel of the Employee Voucher in the Override Type and Override Amount fields.

| • | You can override for State Income Tax in the purple highlighted section. One of the options available is to Block Withholding. |

In the following example, the employee's State Income Tax calculation is $50.30.

The Block Withholding option allows you to block calculated tax. Wages will still accrue. For example, if you have requested to block the tax, then the amount withheld will be $0.00. The override is denoted in the Filing Status panel of the voucher in the Override Type and Override Amount fields.

Tax Calculation Overrides

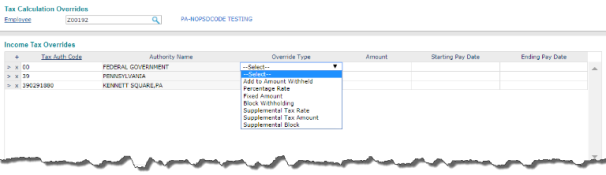

| • | Open Tax Calculation Overrides (found in the menu under Payroll|Action). |

In the Income Tax Overrides panel, you can override all the taxes in the same section. One of the options in the Override Type drop-down is Block Withholding.

To override, enter the authority ID (not the whole Tax Deduction Code). Entering 00 will only affect Federal Income Tax and entering a state code will only affect the State Income Tax.

A Starting Pay Date and Ending Pay Date must be entered in order for these to take effect. The entry will be ignored if there is no date.

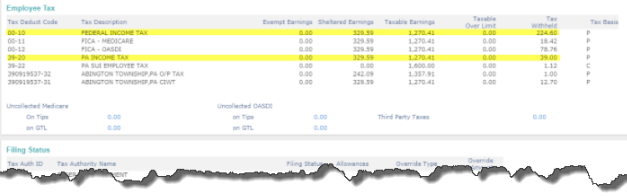

In the following example, the employee's Federal Income Tax calculation is $224.60. The State Income Tax calculation is $39.00.

The Block Withholding option allows you to block calculated tax. Wages will still accrue. For example, if you have requested to block Federal Income Tax and State Income Tax, then the amount withheld will be $0.00 and $0.00. The override is denoted in the Filing Status panel of the voucher in the Override Type and Override Amount.

Note: This will not affect Local Income Tax. Even if entered, it will be ignored.

Suppress Taxes

There are several places in the system that can be used to suppress taxes. Suppressing taxes not only suppresses the tax calculation, but will also suppress the wages from accruing. In most cases, reciprocity is still taken into consideration when using suppress.

The following are examples:

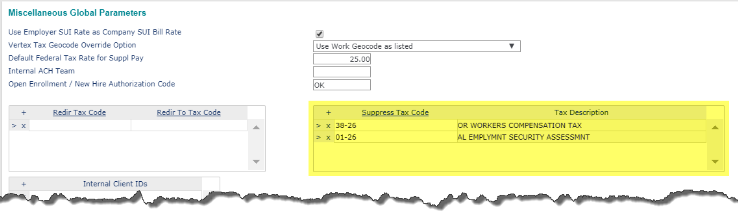

| • | Open System Parameters (found in the Back Office menu under System|Change). Open Miscellaneous Global Parameters by selecting Miscellaneous Parameters in the Actions menu menu. |

This will suppress taxes system-wide and is available for all tax codes (employee and/or employer).

Note: Reciprocity is still taken into consideration when using suppress at the system level.

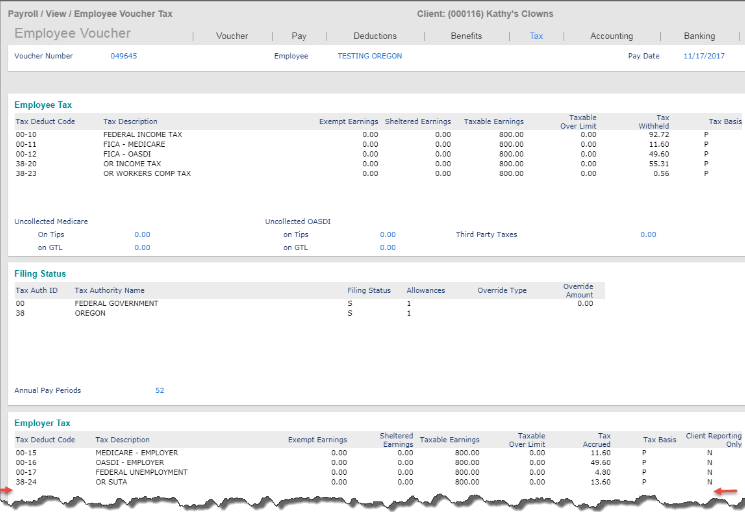

In the example above, the tax code 38-26 is being suppressed. This means on the calculated voucher, this tax will not appear at all.

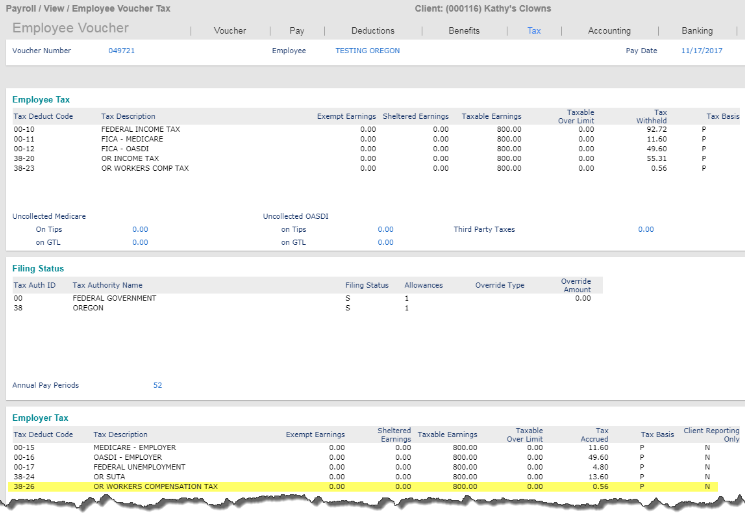

If the tax suppression is removed, the wages are accrued and the tax is calculated:

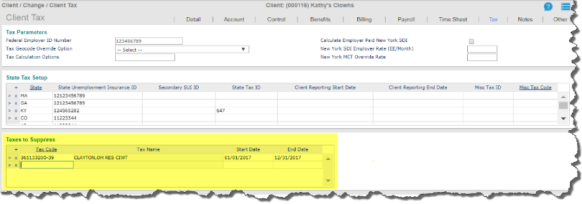

| • | Open the Tax tab on Client Details (found in the menu under Client|Change). |

This will suppress taxes client-wide and is available for all tax codes (employee and/or employer).

Note: Reciprocity is still taken into consideration when using suppress at the client level.

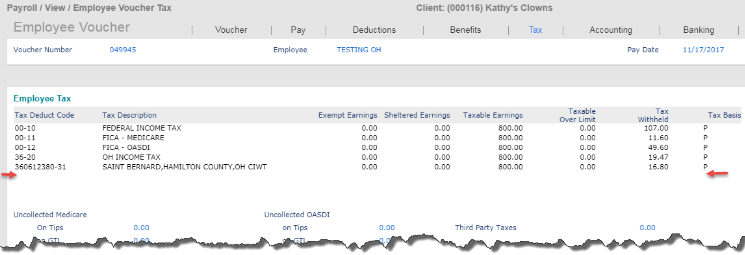

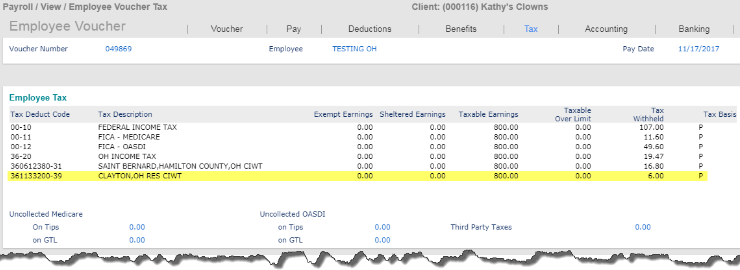

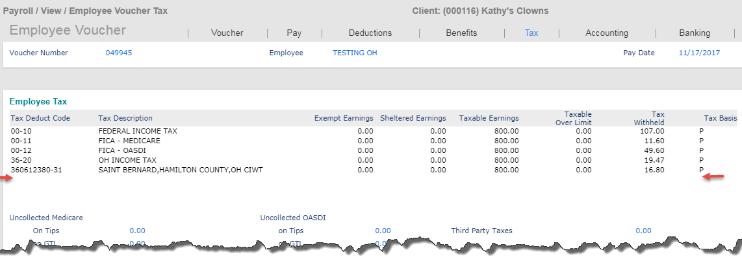

In the example above, the tax code 361133200-39 is being suppressed. This means on the calculated voucher, this tax will not appear at all.

If the tax suppression is removed, the wages are accrued and the tax is calculated:

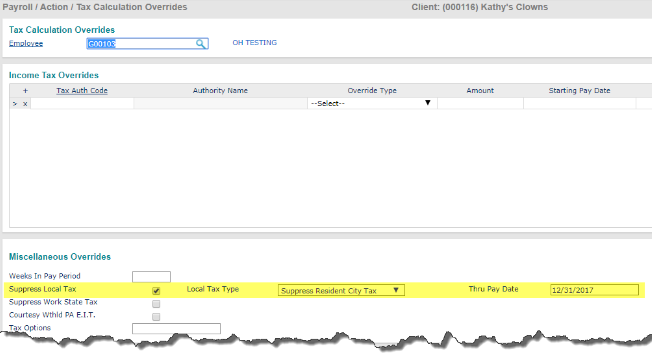

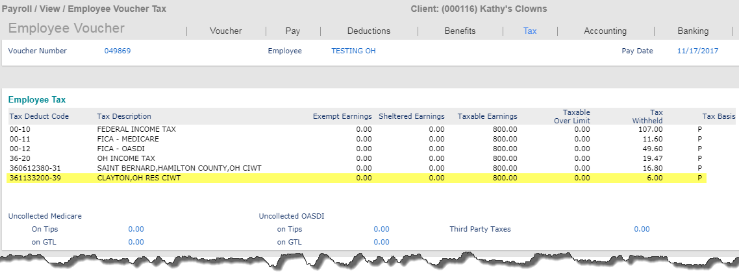

| • | Open Tax Calculation Overrides (found in the menu under Payroll|Action). In the Miscellaneous Overrides panel, check the Suppress Local Tax checkbox. |

This checkbox will allow you suppress either the resident city tax or the resident local tax for the specified employee.

Note: Reciprocity is still taken into consideration when using suppress here.

In the example above, the resident city tax is chosen. This will suppress both the wages and the taxes. The tax code will not appear on the voucher at all.

If the tax suppression is removed, the wages are accrued and the tax is calculated:

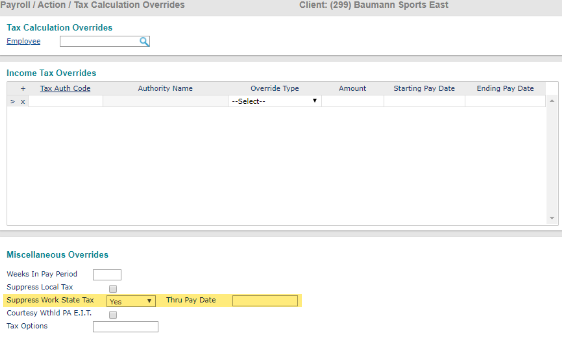

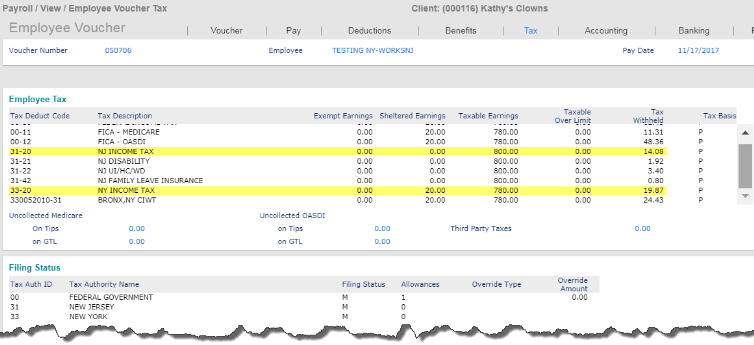

| • | Open Tax Calculation Overrides (found in the under Payroll|Action). In the Miscellaneous Overrides panel, select Yes in the Suppress Work State Tax drop-down. |

This will allow you suppress the work state tax for the specified employee.

Note: Reciprocity is also suppressed using this option.

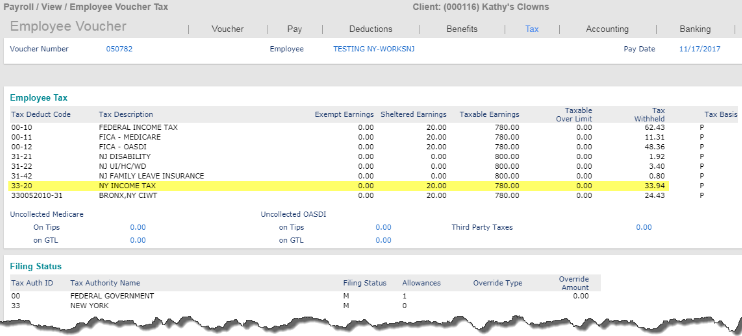

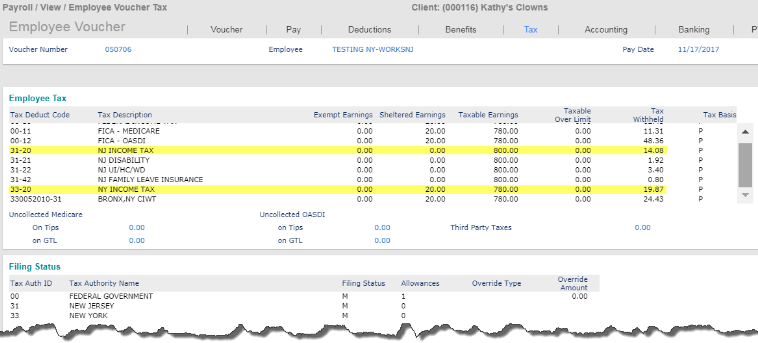

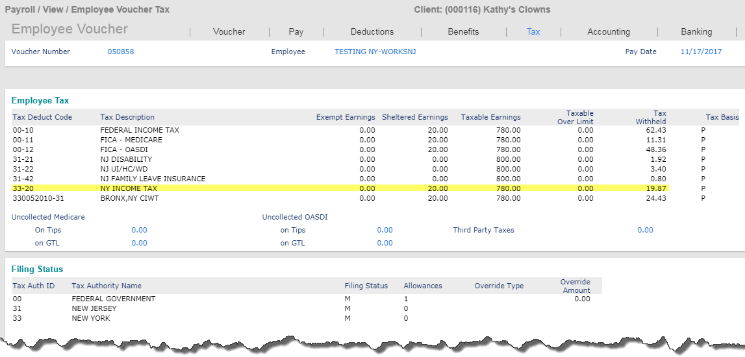

In the example above, this will suppress both the wages and the taxes. The tax code will not appear on the voucher at all (in this case, New Jersey Income Tax (tax code 31-20)).

If the tax suppression is removed, the wages are accrued and the tax is calculated:

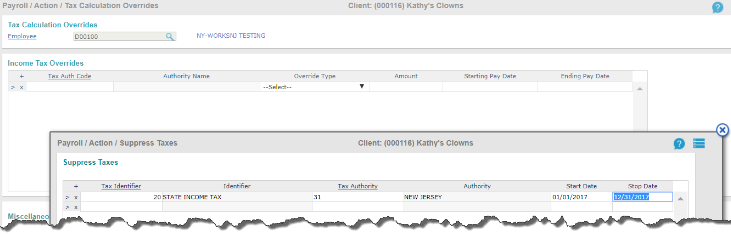

| • | Open Tax Calculation Overrides (found in the menu under Payroll|Action). In the Actions menu, select Suppress Taxes. |

This screen allows you to suppress taxes at the employee level for all tax codes.

Note: Reciprocity is still taken into consideration when using suppress here.

In the example above, this will suppress both the wages and the taxes. The tax code will not appear on the voucher at all (in this case, New Jersey Income Tax (tax code 31-20).

If the tax suppression is removed, the wages are accrued and the tax is calculated:

Blocking and Suppressing Taxes

| • | The tax is suppressed, but the resident tax is still not taking enough |

If you want to suppress a tax and not have the reciprocity taken into consideration, what you would want to do is both block the tax and suppress the tax. This will act like the suppression (i.e., no wages will accrue), but will block the tax from reciprocity.

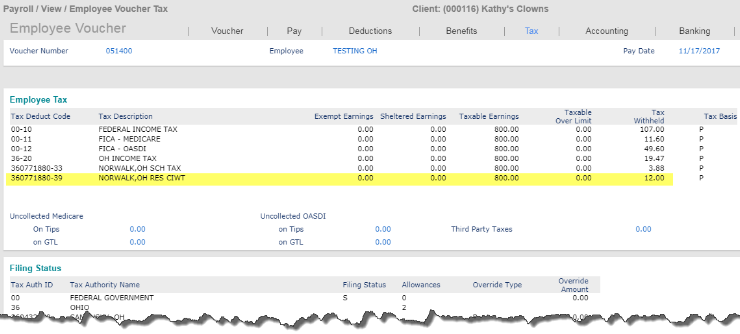

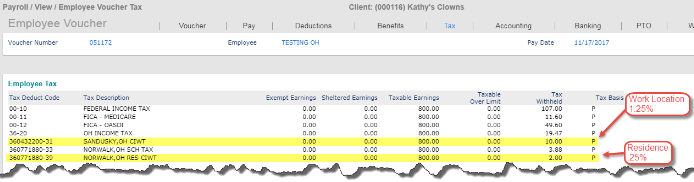

In the following example, the employee lives in Norwalk, OH and works in Sandusky, OH. The tax rate for Norwalk is 1.5% and the tax rate for Sandusky is 1.25%.

The following conditions are applicable to wages taxes for Ohio residents who live and work in different Ohio municipalities:

| • | Withhold tax for city employment, and |

| • | Withhold tax for the city of residence, reduced by the credit amount allowed by the city of residence. |

With no suppressions or blocks, the employee’s tax will calculate at 1.25% for Sandusky and will calculate at .25% for Norwalk. This is because Norwalk allows a 100% credit up to 1.50% for the tax paid to the city of employment (which was 1.25%).

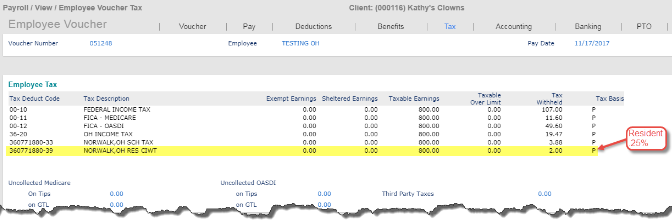

If the Sandusky location is suppressed, it will suppress both the tax and the wages. Reciprocity is still taken into consideration when using suppress, so the Norwalk taxes will still be reduced by what would have calculated for Sandusky.

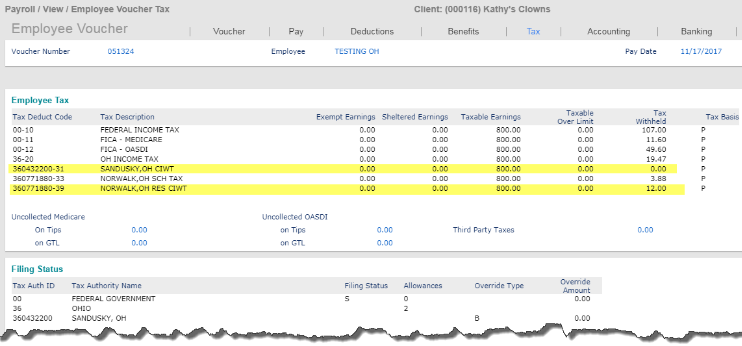

If the Sandusky tax is blocked, it will just block the tax from calculating but the wages will still accrue. Reciprocity is also blocked here.

But, if you do not want the wages to accrue either, if you block and suppress the tax, it will act like a suppression but will block the reciprocity.