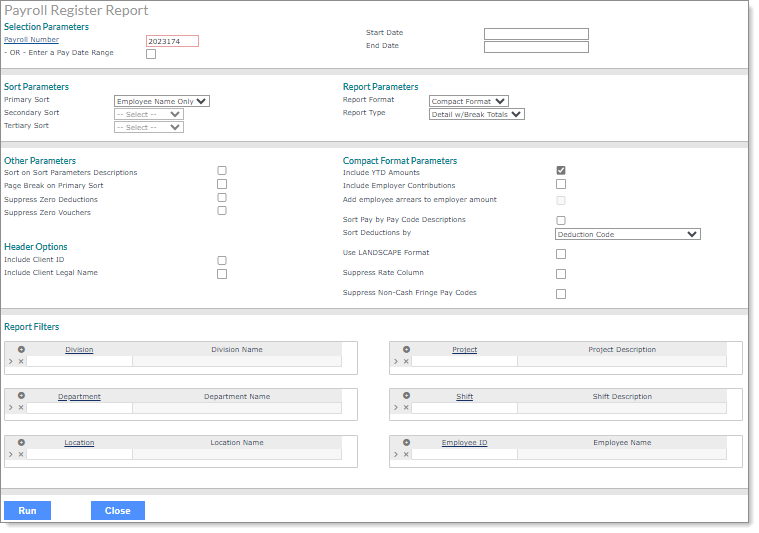

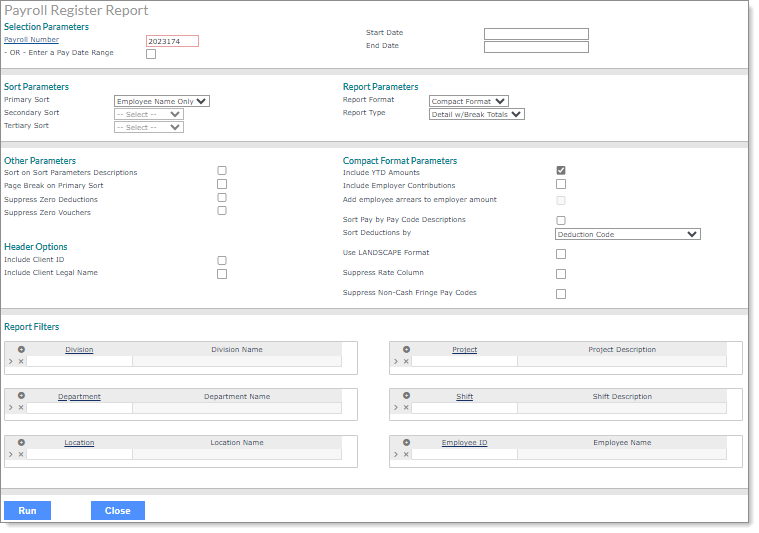

Payroll Register Report

Use the Payroll Register Report form to determine what information prints on the Payroll Register Report and in what order. For example:

To access this form, click Reports menu. Under Payroll|Report, click Payroll Register Report.

Note: You can also access the Payroll Register Report for a selected payroll in the Approval Payroll Reports form. To do this, select Approval Payroll Reports in the View Report/Analytic field on the Payroll Approval form, then select Payroll Register Report in the Report Title column.

To configure information for display on the Payroll Register Report:

|

1.

|

Enter the Selection Parameters to determine what displays on the report: |

|

•

|

Enter the Payroll Number to run this report for a specific payroll or select Enter a Pay Date Range to enter a Start Date and an End Date to run this report for a date range. |

|

2.

|

Set the Sort Parameters: |

|

•

|

Select the Primary Sort for the report. If Employee Name Only is selected then Secondary Sort and Tertiary Sort will not be available. |

|

•

|

You can select a Secondary Sort and Tertiary Sort. |

|

3.

|

Set the Report Parameters: |

|

•

|

Select the Report Format: |

|

•

|

Standard: Includes information for each employee on the report, as well as the current, month-to-date, quarter-to-date, and year-to-date values for pay, deductions, taxes, and paid time off. |

|

•

|

Compact: Displays the information in a columnar format and makes the Compact Format Parameters available (see below). |

|

•

|

Select the Report Type: |

|

•

|

Detail w/Break Totals: Includes a break and a sub-total for each of the sort options entered (except employee name), as well as a grand total for all employees. |

|

•

|

Detail Only: Includes the detail information without sub-totals, only a grand total for all employees. |

|

•

|

Summary Only: Does not include details, but only sub-totals for each of the sort options entered (except employee name) as well as a grand total for all employees. |

|

4.

|

Set the Other Parameters: |

|

•

|

Select Sort on Sort Parameters Descriptions to sort the report by the descriptions instead of the codes selected as the Sort Parameters. |

|

•

|

Select Page Break on Primary Sort to start a new page for the selected Primary Sort items. |

|

•

|

Select Suppress Zero Deductions to exclude deductions with a value of zero from the report. |

|

•

|

Select Suppress Zero Vouchers to exclude payroll vouchers with a total of zero from the report. |

|

5.

|

Set the Compact Format Parameters (if this is a Compact report format): |

|

•

|

Select Include YTD Amounts to include the year-to-date amounts for pay, deductions, and taxes on the report. |

|

•

|

Select Include Employer Contributions to include the employer’s contribution amounts for deductions on the report. |

|

•

|

Select Add employee arrears to employer amount to include employee arrears as part of employer contribution amounts on the report. |

|

•

|

Select Sort Pay by Pay Code Descriptions to sort the pay by the code descriptions instead of the pay codes. |

|

•

|

Indicate the order in which to Sort Deductions by: |

|

•

|

Deduction Code: Sorts deductions by Deduction Code. |

|

•

|

Deduction Description: Sorts by Deduction Code Descriptions. |

|

•

|

Benefit Plan, Deduction Code: Sorts by the Benefit Plan ID associated with the deduction, if any, then the Deduction Code. |

|

•

|

Benefit Plan, Deduction Description: Sorts by the Benefit Plan ID associated with the deduction, if any, and then by the Deduction Code Description. |

|

•

|

Select Use LANDSCAPE Format and one or both of its associated parameters, Include YTD Amounts and Include Employer Contributions, to control landscape output form selection. |

Note: If you do not select one of these parameters, the system uses the standard report size, even if the Use LANDSCAPE Format field is selected. In addition, you cannot use this parameter with the Suppress Rate Column parameter.

|

•

|

Select Suppress Rate Column and Include YTD Amounts to suppress the Rate column in the report output, which provides enough display room to accommodate larger YTD amounts and their commas. (This parameter is only available in Portrait format. If you enable the Use LANDSCAPE Format parameter and the Suppress Rate Column parameter a warning displays, "Cannot select Landscape with Suppress Rate Column option.") |

Note: The Include Employer Contributions parameter is not available with the Suppress Rate Column parameter. If you enable the Includes YTD Amounts and the Suppress Rate Column parameters with that parameter a warning displays, "Cannot select Include Employer Contributions with Suppress Rate Column option."

|

•

|

Select Suppress Non-Cash Fringe Pay Codes to exclude non-cash fringe pay codes, which helps differentiate between what is actual pay and what is non-cash fringe pay. |

|

6.

|

Set the Header Options: |

|

•

|

Select Include Client ID to include the client's ID in the report's header |

|

•

|

Select Include Client Legal Name to include the client's legal name in the report's header |

|

7.

|

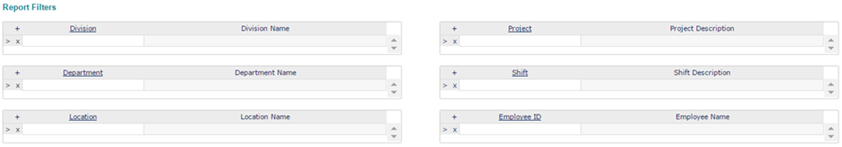

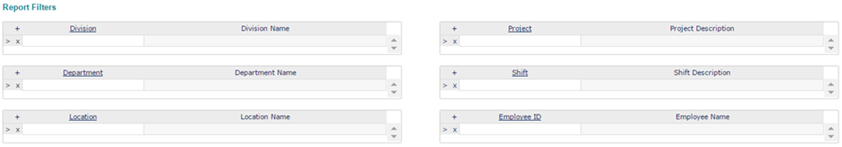

Enter the Report Filters to display on the report: |

|

•

|

Enter the field type. The field label displays. For example, if you enter a Location, the Location Name displays. The report displays records for that Location. |

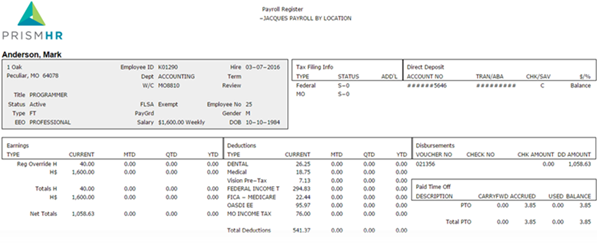

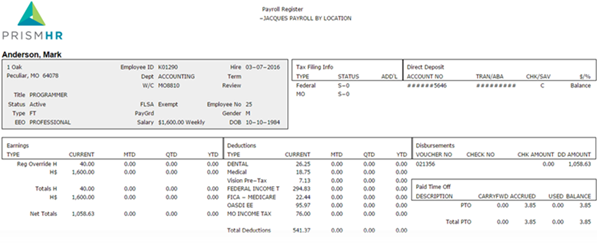

Listed are samples of the report columns, based on Standard format:

|

•

|

Employee Name: Employee name displays as last name first. |

|

•

|

Employee ID: The Employee ID displays when the report is run in compact format. |

|

•

|

Address: Employee Residential Address |

|

•

|

Title: Employee Position Title |

|

•

|

Status: The employee's employment status (for example, Active or On Leave). |

|

•

|

Type: The employee's employment type (for example, Full-Time or Part-Time). |

|

•

|

EEO: The employee's position EEO class. |

|

•

|

Employee ID: Employee ID |

|

•

|

Dept: The employee's assigned department. |

|

•

|

W/C: The employee's assigned workers' compensation class code. |

|

•

|

FLSA: The employee's FLSA type (for example, Standard, Highly Compensated, or Exempt). |

|

•

|

PayGrd: The employee's pay grade based on their position title. |

|

•

|

Salary: The employee's compensation amount based on the pay group. |

|

•

|

Hire: The employee's last hire date. |

|

•

|

Term: The employee’s termination date, if any. |

|

•

|

Review: Date of employee's last review. |

|

•

|

Employee No: Employee Number |

|

•

|

Gender: Employee Gender |

|

•

|

DOB: Employee date of birth |

|

•

|

Type: Type of tax filing (for example, Federal, AR, AZ). |

|

•

|

Status: Status of tax filing |

|

•

|

Add'L: Additional codes associated with that tax type. |

|

•

|

Account No: Employee Bank Account Number |

|

•

|

Tran/ABA: Employee Bank Transaction Number |

|

•

|

CHK/SAV: The employees (C) checking or (S) saving account where the pay amount is deposited |

|

•

|

$/%: The amount or percentage that is deposited. Balance displays when it is the last deposit or only deposit. |

|

•

|

Type: Pay Code and Description |

|

•

|

Current: the pay amount for this pay period. |

|

•

|

QTD: Quarter-to-date pay |

|

•

|

Type: Deduction Description |

|

•

|

Current: The deduction amount for this type during this pay period. |

|

•

|

MTD: Month-to-date deduction |

|

•

|

QTD: Quarter-to-date deduction |

|

•

|

YTD: Year-to-date deduction |

|

•

|

Voucher No: Voucher Number |

|

•

|

Check Amount: The amount of this check |

|

•

|

Direct Deposit Amount: The amount that is direct deposited for this check/voucher. |

|

•

|

Description: Paid Time Off Description |

|

•

|

CarryFWD: The amount of paid time off carried forward. |

|

•

|

Accrued: The amount of paid time off accrued in this pay period. |

|

•

|

Used: The amount of paid time off used in this pay period. |

|

•

|

Balance: The amount of paid time off available after this paid period. |

|

•

|

Grand Total: Total for all employees. |

|

•

|

Total Employee Count: The number of the employees included in the report. |

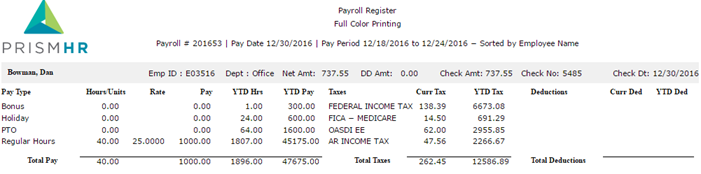

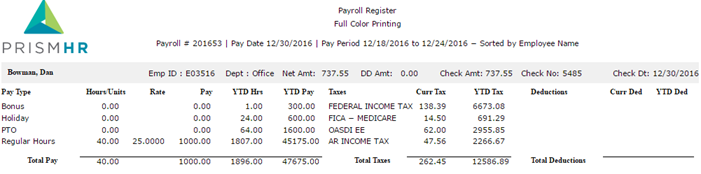

Listed are a sample of the report columns, based on Compact format:

|

•

|

Employee Name: Employee name displays as last name first. |

|

•

|

Dept: Employee department |

|

•

|

Net Amt: Net pay amount for this pay period. |

|

•

|

DD Amt: Direct deposit amount |

|

•

|

Check Amt: Check amount |

|

•

|

Check Dt: The date the employee is paid. |

|

•

|

Pay Type: Pay Description |

|

•

|

Hours/Units: Hours or Units in pay period. |

|

•

|

Rate: Pay rate for pay period. |

|

•

|

Pay: Pay amount for pay period. |

|

•

|

YTD Hrs: Year-to-date hours |

|

•

|

YTD Pay: Year-to-date pay amount |

|

•

|

Totals Pay: Total for pay type columns |

|

•

|

Curr Tax: Tax amount for this pay period. |

|

•

|

YTD Tax: Year-to-date tax amount |

|

•

|

Totals Taxes: Total for tax type columns. |

|

•

|

Deductions: Deduction Description |

|

•

|

Curr Ded: Deduction amount for this pay period. |

|

•

|

YTD Ded: Year-to-date deduction amount |

|

•

|

Totals Deductions: Total for deduction type columns. |

|

•

|

Grand Total Total for all employees. |

|

•

|

Total Employee Count: The number of the employees included in the report. |