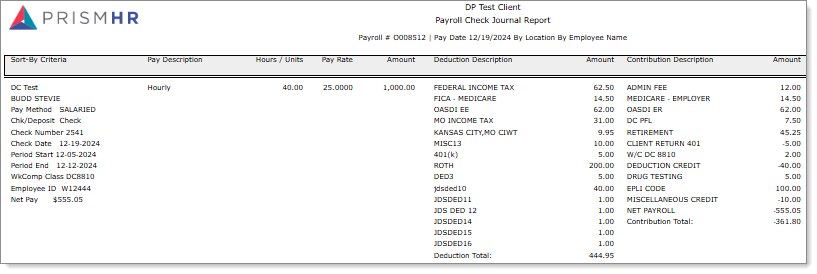

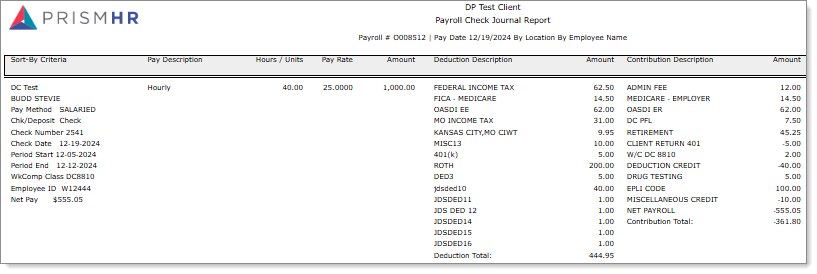

Payroll Check Journal Report

This report provides employee payroll check details, including the pay method, check/deposit, check date, start/stop period, workers compensation class, employee ID, and net pay. (This report is part of the Payroll Initialization reports.)

To access the form, click Reports menu. Under Payroll|Report, click Payroll Check Journal Report.

Note: You can also access the Payroll Check Journal Report for a selected payroll in the Approval Payroll Reports form. To do this, select Approval Payroll Reports in the View Report/Analytic field on the Payroll Approval form, then select Payroll Check Journal in the Report Title column.

To set up the parameters for this report:

|

1.

|

Enter the Selection Parameters to determine what displays on the report: |

|

•

|

Enter the Payroll Number to run this report for a specific payroll or select Enter a Pay Date Range to enter a Start Date and an End Date to run this report for a date range. |

|

2.

|

Set the Sort Parameters: |

|

•

|

Select the Primary Sort for the report. |

|

•

|

You can select a Secondary Sort and Tertiary Sort. |

|

•

|

Select the Detail Sort (Employee Name, Employee ID). |

|

3.

|

Select the Report Parameters as needed: |

| Report Type |

Select the Report Type:

|

•

|

Detail with Break Totals: Includes a break and a sub-total for each of the sort options entered (except employee name), as well as a grand total for all employees. |

|

•

|

Detail only: Includes the detail information without sub-totals, only a grand total for all employees. |

|

•

|

Summary only: Does not include details, but only sub-totals for each of the sort options entered (except employee name) as well as a grand total for all employees. |

|

| Report Format |

Select the Report Format (Standard, With Summarized Fees and Taxes, With Bundled Billing). |

|

Sort on Codes instead of Descriptions

|

Select to sort by pay code rather than pay description.

|

|

Page Break on Primary Sort

|

Select to start a new page for a new Primary Sort.

|

|

Suppress Pay Group in Header

|

Select to exclude the Pay Group, Pay Period Start, and End Dates in the report header.

|

|

4.

|

Select the Other Parameters as appropriate: |

| Employee Unique ID |

Select the Employee Unique ID to use in the report (Employee ID, Employee Number). |

| Display Pay Codes Using Timesheet Detail Format |

Select to display the same detail as the time sheet and voucher. |

|

Include Expense Reimbursements

|

Select to include expense reimbursement pay codes.

|

|

Include Non-Cash Pay Codes

|

Select to include non-cash as well as cash pay codes.

|

|

Include 'Employee Total Expense' on Report

|

Select to include the Employee Total Expense, which is the sum of all pay and contributions.

|

|

Employee Unique Clock Number

|

Select which "clock number" to use in the report:

|

•

|

Employee Number: The report obtains the employee number from the payroll voucher. |

|

•

|

Employee Clock Number: The report obtains the clock number from the employee details. |

|

|

Suppress Employee Names on the Report

|

Select to exclude employee sort names from the report.

|

|

Consolidate Report Totals by Pay Code Only

|

Select to display the totals by pay code, rather than detail lines.

|

|

Exclude Check Detail Information

|

Select to exclude detailed check information (check number, check date, and period start and end dates).

|

|

Split Hours and Units Columns

|

Select to display columns for Paid Hours and Paid Units. Paid Hours specifies pay codes with pay reason set to hours and Paid Units specifies pay codes set.

|

|

5.

|

Enter the Report Filters to display on the report: |

|

•

|

Enter the field type. The field label displays. For example, if you enter a Location, the Location Name displays. The report displays records for that Location. |

|

6.

|

Click Run. The Payroll Check Journal Report displays. For example: |

Listed are samples of the report columns, based on selections in the form:

|

•

|

Sort-By Criteria: The field selected in the Primary Sort. |

|

•

|

Employee Name: Employee name displays as last name first. |

|

•

|

Pay Method: The method in which the employee is paid. |

Note: Employees assigned the Variable Salary option in the Pay Method field on the Employee Details form displays as "Salaried" in the on-screen and .xls report output. (The Variable Salary option only displays if the VARSALMETHOD custom feature code is enabled on the System Parameters form.)

|

•

|

Chk/Deposit: How the check was issued to the employee. |

|

•

|

Check Number: The number on the check. |

|

•

|

Check Date: The date the check was issued. |

|

•

|

Period Start: The date the pay period started. |

|

•

|

Period End: The date the pay period ended. |

|

•

|

WkComp Class: The employees Workers' Compensation Class. |

|

•

|

Employee ID: Employee ID |

|

•

|

Net Pay: The net pay on the check. |

|

•

|

Pay Description: The pay code description. |

|

•

|

Hours/Units: The number of hours or units for the pay period. |

|

•

|

Pay Rate: The employee's rate of pay. |

|

•

|

Amount: The employee's amount of pay for the selected date range or payroll batch. |

|

•

|

Deduction Description: The deduction code description. |

|

•

|

Amount: The amount of the deduction for the selected date range or payroll batch. |

|

•

|

Contribution Description: The contribution code description. |

|

•

|

Amount: The contribution amount for the selected date range or payroll batch. |