Overriding Vacation Pay

In addition to an employee’s regular pay, some clients issue a separate vacation payroll voucher on the pay date prior to the employee’s actual vacation. Because a lump sum total of multiple weeks would prompt a disproportionately higher tax rate than if the tax was determined according to weeks worked, PrismHR allows you to override the vacation vouchers.

To override vacation voucher calculations, perform the following steps before you initialize the batch in which this employee will be paid.

To override vacation voucher calculations, do the following:

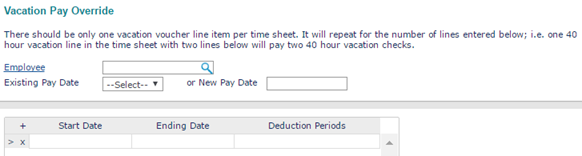

| 1. | Enter the Employee by either entering the name, Social Security Number, or ID to display a pop-up list of matching employee records. You can also click the field label or press Ctrl+Enter with your cursor in this field to open the search window. |

| 2. | Select the Existing Pay Date for the override, or enter a New Pay Date to create a new override. |

| 3. | You can specify up to ten vacation vouchers: |

| a. | Enter the Start Date of the period paid on this vacation voucher. |

| b. | Enter the Ending Date. |

Note: Be sure the Ending Date is correct; PrismHR uses this date to update the Benefits Thru Date field on the Employee Details Work tab. The Benefits Thru Date indicates the last date that benefits were calculated for this employee. During payroll processing, the system refers to the Benefits Thru Date to determine whether a benefit deduction is due. For example, when the system processes a check for an employee whose Benefits Thru Date is in the future, it does not calculate benefits.

| c. | Enter the Deduction Periods (1-5) that correspond to the pay periods paid on the vacation voucher. These override the periods on the Batch Control Record. |

| 4. | Click Save. |