Scheduling 'One-Time' Deductions Imports

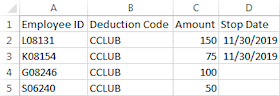

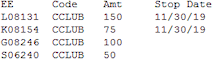

To use the Scheduled Deductions file import, you must have a tab-delimited text file with the columns shown in Table 82. If you have a row with invalid information (such as a header row), the system automatically displays a warning message and does not import the content.

Note: The decimal place in the Amount column is optional. If there are more than three decimal places, the system rounds it to two.

Note: If you create the file in a program such as Excel, you must save it as a tab-delimited TXT file.