Reversing an Employee Payroll Voucher

Use the Employee Payroll Voucher Reversal form to reverse an employee’s payroll voucher. You can reverse a payroll voucher if it was issued in error and it has not yet been cashed or deposited.

Important! The system prevents you from reversing an adjustment voucher that was created by reclassifying a direct deposit. (Reversing these adjustment vouchers could create a check for a negative amount.)

In addition, you cannot reverse payroll vouchers when a direct deposit is sent to a check using the Reclassify Direct Deposit form. In this scenario, you cannot reverse these types of adjustment vouchers using the Employee Payroll Voucher Reversal form. If you try to perform this function a message displays, "You may not reverse this adjustment voucher."

When you void the original voucher in this scenario, the following happens:

|

•

|

The system also voids the adjustment voucher created by sending a deposit to a check. A warning message displays to alert you while the system validates the voucher number, "This voucher had an adjustment voucher created by sending direct deposits to a check. If you void this voucher then the other voucher will be voided also." |

|

•

|

If all the ACH deposits were sent to a check, then the system does not prompt you to draft from the employee's account. However, if only some of the ACH deposits were sent to a check, then the system prompts you about reversing the remaining deposits, "This voucher contains ACH items, some of which were converted to a check. Reverse the remaining ACH amounts (drafted from the employee's account)?" If you select Yes, the system creates an ACH journal after the voucher is voided to recover the amount of the deposit that was not sent to a check. |

|

•

|

If you choose to draft the remaining deposits from the employee, the system prompts whether you want to put the reversal on hold pending recovery of the ACH. If you select Yes, the system does not post the reversal for the original voucher and does not create the reversals for the adjustment voucher until later when you confirm the pending reversal. |

Note: The process to reverse a payroll uses the same method described above, but the system does not provide any prompting.

To reverse an employee's payroll voucher, do the following:

|

1.

|

Go to the Payroll|Action menu and select Employee Payroll Voucher Reversal. |

|

2.

|

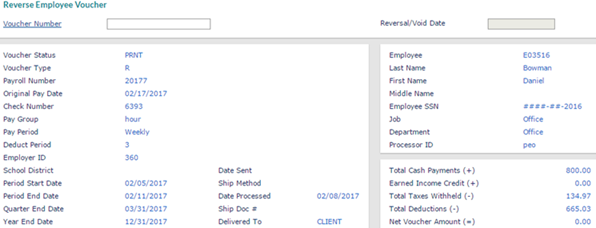

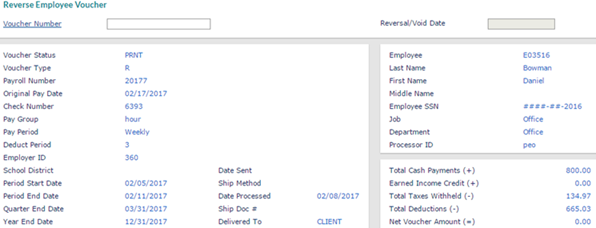

Enter the Voucher Number. Note the following: |

|

•

|

If the system displays a message that informs you that the date was changed to today, click OK. |

|

•

|

If you select a voucher from a different quarter, the system warns you when it changes the void date to today. This is because there can be tax implications. Click OK, then proceed. |

|

•

|

If the system displays a message that informs you that the maximum days for an ACH Reversal for the checking account is exceeded, then you can choose to either continue or stop the reversal. Click Yes to continue processing the reversal or click No to stop the reversal process and clear the form. |

|

•

|

If you are in different time zones when processing voids, you can enable the system-level custom feature code, UNRESTRICT-VOID-DATE, to edit the Reversal/Void Date. (See Using Custom Feature Codes.) |

Important! This is a global setting, so if you enable the UNRESTRICT-VOID-DATE custom feature code it impacts the Reversal/Void Date field for all users who have access to process voids.

Note the following if you enable the UNRESTRICT-VOID-DATE custom feature code:

|

•

|

After you either dismiss or accept any prompts that are part of the standard voucher reversal, the Reversal/Void Date is available for editing. |

|

•

|

If you select a voucher with a current or future pay date, the Reversal/Void Date is available for editing. |

|

3.

|

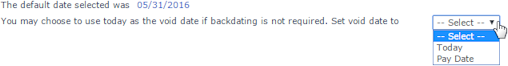

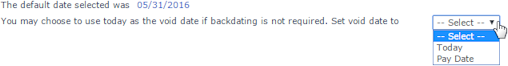

If today’s date is not the same as the voucher pay date, the Voucher Reversal Parameters form opens where you confirm the reversal date. |

|

4.

|

Indicate whether the system should use Today or the Pay Date as the date for the reversal. |

|

6.

|

Click Save. The system prompts you to confirm that you want to void the voucher. |

|

7.

|

Click Yes to confirm that you want to continue. The system displays the Voucher Reversal Parameters form where you can enter the reason. |

|

8.

|

Enter the reason for the void. The reason you enter, as well as your user information, display on the permanent void record. |

|

10.

|

The system displays the processing steps as it voids the voucher. |

|

11.

|

If the client changes their ACH from Active to ACH by Division and then voids a voucher that does not contain a division, the following informational message displays: "The client is set up for ACH by Division, but this record does not have a valid division code. Manual adjustments to return the credit to the client may be required after this reversal is completed." |

|

12.

|

Click Close to return to the cleared Employee Payroll Voucher Reversal form. |

Receiving an Employee Payroll Voucher Reversal Notification

After an Employee Payroll Voucher Reversal is complete and the Client Control for Payroll Finalization Notification is set to Email, the system notifies the user at the email address indicated in the Payroll Finalization email and for worksite managers/worksite trusted advisors with the Payroll Approver H/R Role that the reversal is complete and displays the invoice from the reversal.

Note: The system sends the Payroll Finalization email to worksite managers and worksite trusted advisors designated with the Payroll Approver Human Resource Role on the Users form, including any email addresses listed in the Additional Notification Emails panel on the Control tab in the Client Details form (the Additional Notification Emails panel displays when you select the Email option).

Related Topics

Reversing a Voucher that Includes ACH

Confirming Payroll Voucher Reversals