Defining Pay Code Calculation Rules

Different pay code calculation rules are available based on the Calculation Method selected in the Pay Codes form. Refer to the relevant panel descriptions.

Standard Method Rules

The Standard Method Rules panel displays for pay codes with these calculation methods:

|

•

|

Rate x Hours Paid (Selected Codes); also displays the Fringe Calculation Pay Codes panel |

|

•

|

Rate x Full Hours Worked |

|

•

|

Rate x Straight Hours Worked |

|

•

|

Rate x Union Job Hours Worked |

|

•

|

Rate x Union Project Hours Worked |

Note: The calculation methods that start with “Rate x” also display the Maximum Calc Hours/Maximum % of Gross Earnings field, which is described in Working with Pay Codes.

Complete the following fields:

|

1.

|

Enter the Factor to multiply against the pay rate to arrive at the actual rate used to calculate earnings. You would typically use this to define the rate to pay employees for overtime pay. |

Note: A value of zero (0) or a value greater than or equal to .5 is acceptable for Standard Calculation Method pay codes. (Entering a negative value displays an error message.)

|

2.

|

Select the Rate Class: |

|

•

|

For hourly or unit pay rates, select Straight or Premium time. |

|

•

|

For flat pay rates, select Double Time or Other. |

|

3.

|

Enter the Alt. Pay Rate #, which is the alternate employee pay rate to apply when this pay code is entered on a time sheet. |

Note: If "1" displays in this field and the employee's Sequence 1 Alternate Pay Rate is left blank, no data imports.

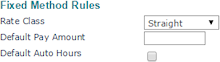

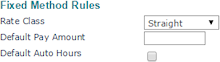

Fixed Method Rules

The Fixed Method Rules panel displays for pay codes with the Fixed calculation method. You can specify the amount in the Amount field or enter it directly on employees' Other Earnings Records.

Complete the following fields:

|

1.

|

Select the Rate Class: |

|

•

|

For hourly or unit pay rates, select Straight or Premium time. |

|

•

|

For flat pay rates, select Double Time or Other. |

|

2.

|

Enter the Default Pay Amount to use when this pay code is entered on employees' Other Earnings Records. |

|

3.

|

Select Default Auto Hours to automatically associate employees' standard hours worked with this pay code. You would typically use this for a salary pay code. |

Calculated Method Rules

The Calculated Method Rules panel displays for pay codes with the Calculated calculation method. The system stores the rate used as a default on the Pay Code Record instead of the Employee Payroll Record or Job Record.

Complete the following fields:

|

1.

|

Enter the Hourly/Unit Rate, which the system multiplies by the number of hours worked/units produced entered in conjunction with this pay code. |

|

2.

|

Enter the Factor to multiply against the pay rate to arrive at the actual rate used to calculate earnings. You would typically use this to define the rate to pay employees for overtime pay. |

|

3.

|

Select the Rate Class: |

|

•

|

For hourly or unit pay rates, select Straight or Premium time. |

|

•

|

For flat pay rates, select Double Time or Other. |

Per Diem Method Rules

The Per Diem Method Rules panel displays for pay codes with the Per Diem calculation method.

Complete the following fields:

|

1.

|

Select the Per Diem Method used to calculate this pay code: percentage, per day, or mileage. |

|

2.

|

Select the Per Diem Taxable Pay Code used for the taxable wages portion of the total wages entered when using the percentage per diem method. |

If the pay code uses the per day method for per diem, this field stores the pay code which, if paid to an employee in the same batch, the amount paid using the pay code is reduced by the amount of the per day amount. For example, if regular wages are $1000, and per diem is $300, during initialization the regular wages are reduced by $300 for a net of $700.

|

3.

|

Select the Per Diem Non-Taxable Pay Code to use for the non-taxable wages portion of total wages entered when using the percentage per diem method. |

|

4.

|

Select the Other Per Diem Taxable Pay Codes, which is the additional pay code for the non-taxable wages portion of total wages entered when using the percentage per diem method. |

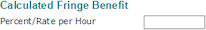

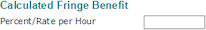

Calculated Fringe Benefit

The Calculated Fringe Benefit panel displays for pay codes with these calculation methods:

Note: These calculation methods also display the Maximum Calc Hours/Maximum % of Gross Earnings field, which is described in Working with Pay Codes.

Enter the Percent/Rate per Hour to calculate for the pay code.

Fringe Calculation Pay Codes

The Fringe Calculation Pay Codes panel displays for pay codes with the Rate x Hours Paid (Selected Codes) calculation method. Use this to set up employee taxable benefits such as insurance, uniforms, a company car, and so on.

Enter each of the Fringe Pay Codes for which hours will accumulate. The system uses these to calculate the fringe benefit amount. The Pay Description displays.

Parent Topic

Working with Pay Codes