Working with ACH Impounding

Use the Offset Impound Accounts form to work with ACH impounding, where the system creates offset transactions for various client fund types. You can designate impound bank accounts where client net-pays, payroll taxes, and retirement contributions are deposited. The system deposits the remainder of the client invoice amount leftover after deducting for net-pays, taxes, and retirement contributions into the bank account designated by the Offset Account ID on the Bank Accounts form.

Note: Historically, PrismHR has supported generating a single ACH transaction to offset the client invoice amount. For a typical payroll, this transaction would be an ACH credit transaction. For most PEO/ASO clients, the total invoice amount is the aggregate of the client fees, employee net pays, taxes, and benefits, such as retirement. The system uses this functionality to designate the impound bank accounts where client net-pays, payroll taxes, and retirement contributions are deposited. The remainder of the client invoice amount leftover after deduction for net-pays, taxes, and retirement are deposited into the bank account designated by the "Offset Account ID" on the primary bank's account form.

Note: You must enable the ACHBREAKONPRBATCH custom feature code on the System Parameters form to access the Offset Impound Accounts form on the Actions menu for the Bank Accounts form.

To set up ACH impounding for an account:

|

1.

|

Go to the Bank Accounts form on the System|Change menu. |

|

2.

|

Enter or select an Account ID. |

|

3.

|

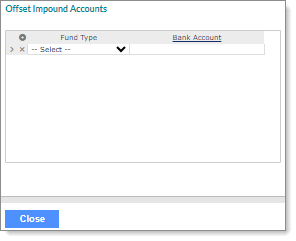

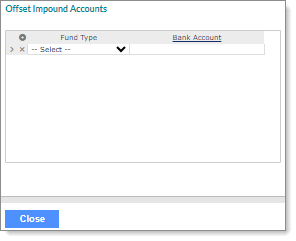

Select Offset Impound Accounts on the Actions menu. |

|

4.

|

Select the Fund Type to designate the billing component for which the offset credit applies on the ACH file. (You can set multiple types.) |

|

5.

|

Enter or select the Bank Account to return records from the system-level Bank Accounts file. |

|

6.

|

Click Close. The Bank Accounts form re-displays. |