Suspense Accounts

Rather than have ACH data update immediately against a cash account before it is transmitted to the bank, which can cause confusion when users attempt to reconcile the account, your organization might want to create a “suspense” account for any bank account that processes ACH transactions. Each voucher is posted in detail against the suspense account.

During ACH file creation, the total of the vouchers transmitted in a batch comes out of the suspense account and hits the cash account. This allows for easier reconciliation, as the ACH suspense account should be zero each day or reconcilable. It is easier to balance the bank’s daily reports because the totals in the cash account should match the amounts directly.

Bank Account Setup

Set up the bank account in PrismHR.

| 1. | Either create a new bank account or edit an existing one |

| 2. | Select the Use Suspense Accounting option in the ACH Setup panel. |

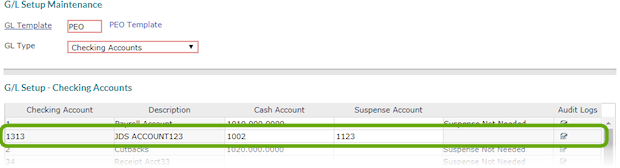

G/L Template Setup

Enter the suspense G/L accounts for the account in the appropriate G/L template.

| 1. | Open G/L Setup Maintenance (found in the Back Office menu under System|Change). |

| 2. | Enter the G/L Template. |

| 3. | From the G/L Type drop-down, select Checking Accounts. The form lists each Checking Account and Description in the system. |

| 4. | For the accounts that indicate they use a suspense account, enter the Suspense GL Account. |

| 5. | Click Save. |

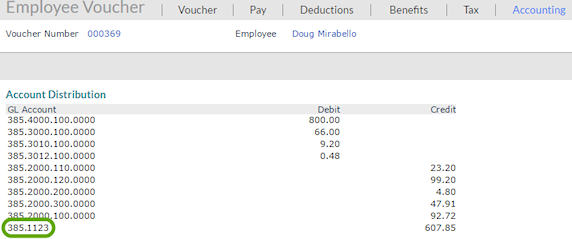

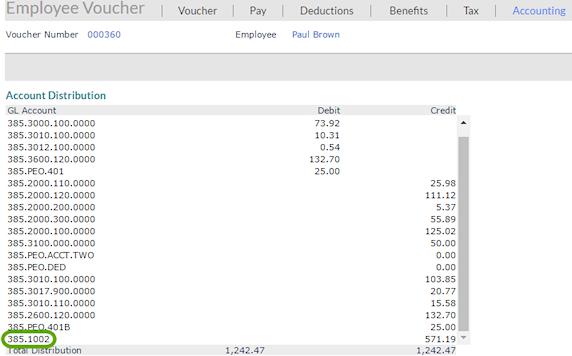

Voucher Examples

The suspense G/L account displays in the Accounting tab of each ACH Employee Voucher.

The standard G/L account displays in the Accounting tab of vouchers for any paper checks.

Once your organization posts the ACH batch, the money moves from the suspense account to the cash account. The Account Distribution on the vouchers does not change.