Setting MasterTax Interface Parameters

This form controls the version number, SBEA vs Non-SBEA reporting breakouts, File IDs and Customer codes for MasterTax. It also features options that control how data is generated on MasterTax reporting files.

To set MasterTax interface parameters:

| 1. | On the Work Centers panel, click MasterTax Processing > Setup Forms > Mastertax Interface Parameters. |

| 2. | Complete these fields as required: |

|

Field |

Description |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Mastertax Interface Active |

Activates the MasterTax interface. Enable this to have the system write transactions to the TAX.JOURNAL file automatically during batch posts, voucher reversals, or tax adjustment posts. |

||||||||||||||||||

|

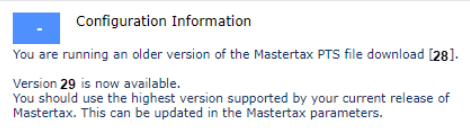

Mastertax PTS Import File Version |

Select the appropriate version of the PTS import file. PrismHR setting this to Version 29, the most recent supported version. If you are running a version of the MasterTax PTS Import File that is version 28 or older, you will receive and the following error message:

Position 57-58 on the header record Line 1 in 000 record will reflect “29”. Note: MasterTax PTS has required updates for Alabama withholding overtime wage reporting changes in record 500 - starting in Q1 2024. PrismHR now supports this when using version 28 in the MasterTax PTS Import File Version field in the MasterTax Interface Parameters form. These changes should only appear when using Version 28 in the MasterTax PTS Import File Version field. If you are using Version 20 or earlier, you will not see the updates.

|

||||||||||||||||||

|

Include Dashes on all Eins and Feins |

Enable this option to include dashes in both federal and client federal entity Employer Identification Numbers (EINs) on the PTS file. Note: You cannot enable this field if Include Dashes on Non Federal Eins Only is already enabled. |

||||||||||||||||||

|

Include Dashes on Non Federal Eins Only |

Enable this option to include dashes only in the EINs of client federal entities (F codes) on the PTS file. The file will not print dashes in any FEINs. Note: You cannot enable this field if Include Dashes on all Eins and Feins is already enabled. |

||||||||||||||||||

|

Provide SBEA Payroll Breakout |

Enable this option to create F codes on the PTS file for clients that are under a certified employer. This includes creating tax liabilities, by client, for federal taxes. |

||||||||||||||||||

|

SBEA Breakout Start Date |

Date when the SBEA payroll breakout occurs. |

||||||||||||||||||

|

Include Certified Relationship Setups |

Enable this item to create 210 records for the F codes. The 210 record is required to set up company and pay agent linking in MasterTax. |

||||||||||||||||||

|

Mastertax RTS Import File Version |

Select the MasterTax RTS file version used by your system. PrismHR recommends setting this to the highest possible value, which corresponds to the most recent supported version. Presently, MasterTax RTS is updated to V48 in PrismHR.

You are running an older version of the mastertax RTS file download [<Version Number>]. You must be on version 48 in order to generate the RTS file out of Prism. Your current version can be edited on the Mastertax Interface Parameters. The header on the MasterTax RTS file now also reflects 48 in Line 1 in 000 record in positions 57-58, with or without the Schedule R Breakout field selected.

|

||||||||||||||||||

|

Schedule R Breakout |

Enable this item to display F code information for the RTS file. |

||||||||||||||||||

|

Suppress Audit Summary & Detail Rpts |

Enable this item to suppress audit reports when you run the MasterTax RTS file build. |

||||||||||||||||||

|

Mastertax MTS Import File Version |

Select the MasterTax MTS file version used by your system. PrismHR recommends setting this to the highest possible value, which corresponds to the most recent supported version. |

||||||||||||||||||

|

Mastertax File ID |

Enter the unique three-digit file identifier provided by MasterTax. |

||||||||||||||||||

|

Mastertax Customer ID |

Optional: Enter the Access ID provided by MasterTax. |

||||||||||||||||||

|

Mastertax Group Code |

Use this code to differentiate PTS files when you save them in multiple accounts. The structure of the code is:

where |

||||||||||||||||||

|

Mastertax Account ID |

Optional: Enter a prefix that appears in company and employer IDs in the MasterTax download files. This prefix differentiates between clients and employers that have matching IDs across different databases. |

||||||||||||||||||

|

Send Company Tax Record In PTS File |

Enable this item to include a company 210 record in the PTS file. |

||||||||||||||||||

|

Send Company Accounting Record in PTS file |

If you are a PEO managing multiple client accounts, you can now populate the Company General Ledger record 105 within the PTS file for both SBEA and non-SBEA clients.

|

||||||||||||||||||

|

Mastertax Wage Reporting Utilized |

Optional: Enable this item to use the MasterTax Wage Reporting module. If this item is not enabled, the system does not send employee detail records with the RTS file. |

||||||||||||||||||

|

Build FUTA Taxable Register by State |

Enable this item to build FUTA taxable wage records by state (tax code XX-17). This was used for the FUTA credit for the federal government after the recession. If left unchecked, register records are built at the end of the year. |

||||||||||||||||||

|

Override Payment Method |

Select the appropriate method:

|

||||||||||||||||||

|

Additional Medicare Calc Method |

This option is only intended for organizations that have encountered issues reconciling Additional Medicare taxes for employees who worked under multiple employers, but a single Client Federal Entity.

If this describes your use case, enable this setting to implement alternative Additional Medicare tax calculation logic, specifically designed to avoid this issue. |

||||||||||||||||||

|

Include Pennsylvania Work State Flag (Y/N) |

This field is optional. This field is a checkbox. It is selected by default.

Note: This will apply for both SBEA and non-SBEA clients. |

||||||||||||||||||

|

Write PTS/RTS Files To Mastertax Directory |

Note: This parameter does not apply to cloud customers. Enable to write generated files to the MasterTax directory on the PrismHR database server. |

||||||||||||||||||

|

Employer Options |

Select an Employer ID; the Employer Name displays. Fill in the Employer Options field with alphanumeric values up to 20 characters. |

||||||||||||||||||

|

FUTA Credit Reduction Maintenance |

Displays the year in which a FUTA credit reduction was taken and the state where it was taken.

FUTA credit reductions occur when a state borrows money from the Federal Unemployment Trust Fund to pay unemployment insurance benefits for its residents. If a state has outstanding loan balances, this lowers the credit rate by 0.3% for each year in arrears until these loans are repaid. |

||||||||||||||||||

|

SBEA Tax Code Reporting Override |

If you use Schedule R reporting (the client-by-client report breakdown), you can use this setting to override client-level tax reporting. In this table, specify any tax codes that you want to report on the employer level of the MasterTax RTS and PTS files. |

| 3. | Click Save. |