AIR Transmission: Uploading the ACA Files

Use these instructions as general guidelines for submitting final client information to the IRS.

If you submit this file to the state of New Jersey or to Washington, D.C., you must select the NJ State Submission option before you create the file. When you select this option, the system appends a record to the transmission file for every employee who resided in New Jersey or D.C. at some point during the year.

Note: These instructions are not meant to replace the instructions provided by the IRS or your state reporting body. Refer to Section 4 of the Affordable Care Act (ACA) Information Returns (AIR) Submission Composition and Reference Guide, or any documentation provided by your state government.

To submit your ACA transmission files:

|

1.

|

Log in to the AIR UI Channel (Testing or Production) using the credentials for the Contact or Responsible Official on the AIR TCC Application. |

|

2.

|

Select the organization and click Submit Selected Organization. |

|

3.

|

If prompted, select AATS and click Submit Selected Version. The Affordable Care Act Information Returns page displays. |

|

4.

|

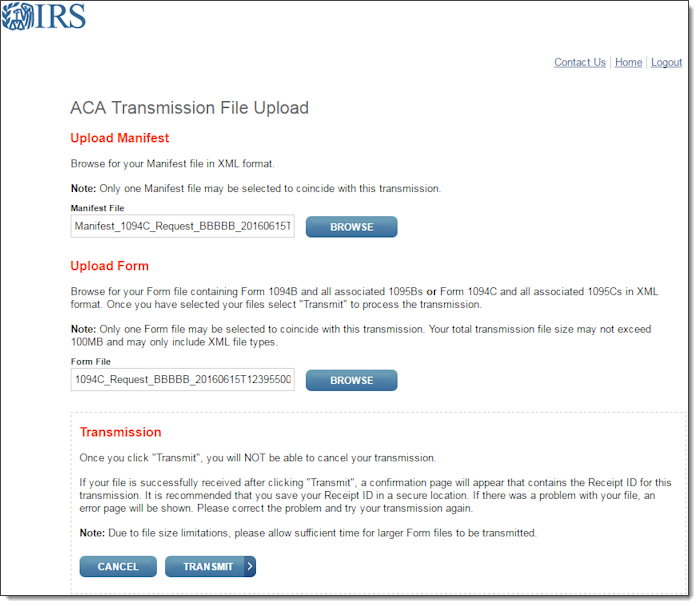

Click Upload ACA Forms. The ACA Transmission File Upload page displays. Use it to upload the Manifest and Form files that you generated for the client. Make sure that these files have the same time stamp and have same names (aside from the prefix), or the IRS will not accept the transmission. |

|

5.

|

Click the Browse button next to the Manifest File field. |

|

6.

|

Find and select the manifest file for the upload. This is the file that begins with the Manifest_ prefix. |

|

7.

|

Click the Browse button next to the Form File field. |

|

8.

|

Select the form file for the upload. It has the same name as the manifest file, only without the prefix. |

|

9.

|

Verify that the information in the ACA Transmission File Upload page is correct. |

|

•

|

If there is a problem with the files, the system requires you to correct them. |

|

•

|

If there is not a problem “at the door”, the system takes you to a page with the Receipt ID. You must make record of it: see Entering the IRS Receipt ID. |

Checking the AIR Transmission Status

Use these instructions as general guidelines for checking the status of the transmission.

Note: These instructions are not meant to replace the instructions provided by the IRS. Refer to Section 4 of the Affordable Care Act (ACA) Information Returns (AIR) Submission Composition and Reference Guide.

To check the status of your transmission file:

|

1.

|

Log in to the AIR UI Channel (Testing or Production) using the credentials for the Contact or Responsible Official on the AIR TCC Application. |

|

2.

|

Select the organization and click Submit Selected Organization. |

|

3.

|

On the Select the AATS Version page, select AATS [Year] and click Submit Selected Version. The Affordable Care Act Information Returns page displays. |

|

4.

|

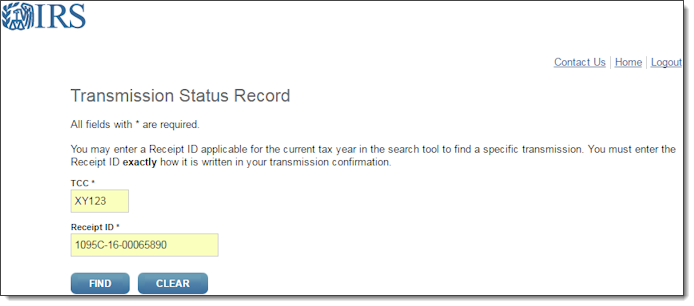

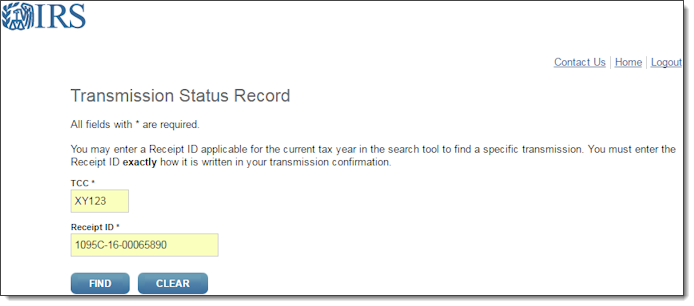

Click Check Transmission Status. The Transmission Status Record page displays. |

|

7.

|

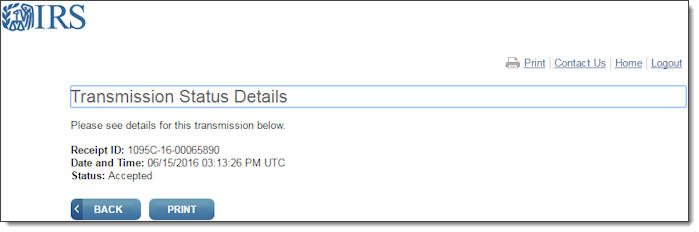

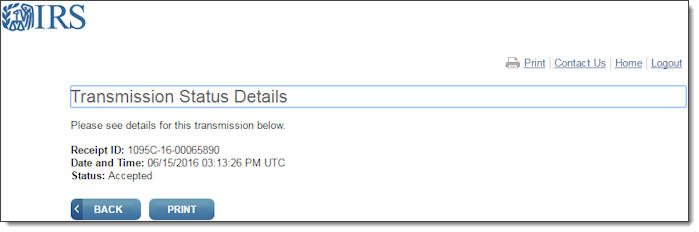

Click Find. The Transmission Status Details page displays. |

Click Back to return to the Transmission Status Record page. Click Print to print the details.