Enrolling Employees in Flexible Spending Accounts

To enroll employees in Flexible Spending Account (FSA) plans, use the Employee Flexible Spending Accounts form.

At the onset of participation in the plan, the employee must choose and commit to a total contribution amount. This amount funds either medical or dependent care expenses incurred by the employee within the plan year.

When the employee is enrolled in a Flexible Spending Account plan, PrismHR automatically adds the deduction to the employee's deduction form. The system calculates the deduction each payroll period. The system uses a calculation that ensures the employee's deduction amount is always up-to-date, even if the employee switches payroll groups, misses a paycheck, and so on.

To set up basic FSA plan parameters for an employee:

| 1. | Complete the following information as required in the Flexible Spending Accounts panel. |

| Use this option | To define this | ||||||

|---|---|---|---|---|---|---|---|

| Employee | The Employee for whom basic information is being set up. Either type the name or ID to display list of matching employee records, or click Employee to open the search window. The system lists any existing adjustments. | ||||||

|

Plan Year |

The FSA Plan Year for which the accounts and elections apply. The system tracks every plan year and their associated accounts, elections, and other information. If the employee continues participation in the plan from one year to the next, you must use this form to establish a new account with a new committed total contribution amount for the next year. HSA plan years must have the format Click the Plan Year link to display the available plan years in the Existing Plan Years section. The system displays the starting date and ending date for each plan. Click the name of a plan year from the list of plans to display the details for that plan for the indicated employee. |

||||||

|

Override Deduction Start Date |

The date when FSA plan deductions begin. The deduction applies to any payrolls with a pay date on or after this date |

||||||

|

Override Deduction Stop Date |

The date when FSA plan deductions cease. The system stops calculating the deduction in any payrolls processed with a pay date after this date. |

||||||

|

Next Pay Date |

A read-only field to view the employee’s next scheduled pay date on the form. Note: Please note the following:

|

| 2. | Click Save. |

The following example illustrates the Flexible Spending Accounts panel.

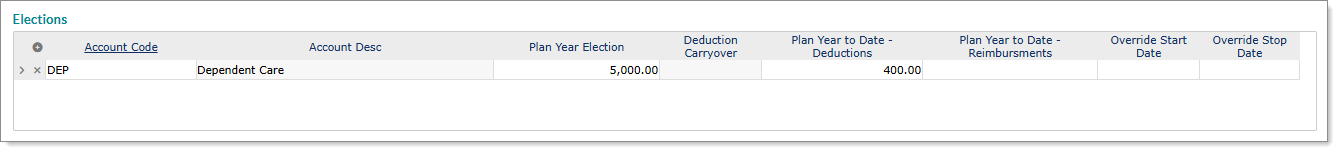

Entering Employee Elections

To enter an employee's elections for a plan, use the Elections panel.

To enter the employee's elections:

| 1. | Complete the following information as required in the Elections panel. |

| Use this option | To define this |

|---|---|

| Account |

Each Flexible Spending Account |

| Plan Year Election | The amount the employee has committed to funding the flexible spending account. |

| Plan Year to Date - Deductions | Deductions that were taken from the employee's pay check. |

| Plan Year to Date - Reimbursements | Reimbursements that have been paid. |

|

Override Start Date |

The date on which to begin payroll deductions for this FSA plan. |

|

Override Stop Date |

The date on which to end payroll deductions for this FSA plan. |

| 2. | Click Save. |

Note: When you enter an employee's elections in the Elections panel, the Carryover Deduction column is blank. After completing the payroll process, the system will update the carryover column with the calculated carryover amount for an employee with a mid-year plan.

The following example illustrates the Elections panel for an employee with a mid-year plan.

Setting Up Override Calculations

To set up override calculations for a flexible spending account, use the Override Calculations panel.

To set up override calculations:

| 1. | Complete the following information as required in the Override Calculations panel. |

| Use this option | To define this |

|---|---|

| Account | Each Account selected in the Elections panel. |

| Deduction Override | The non-standard Deduction Override to deduct each pay period, if the employee changed pay cycles, or was not enrolled for the entire year. |

| Match Override | the non-standard Match Override contributed by the company each pay period. |

| Periods | The alternate deduction period schedule when the deduction and match override amounts apply, instead of applying them to all deduction periods. |

| Over Date | The pay date on which this override applies. If left blank, the system applies the override amount for all pay dates. Override amounts will be used for all pay dates if the Over Date field is left blank. |

| HDHP Not Required | Whether the employee has a Health Savings Account (HSA) but is not enrolled in a High Deductible Health Plan (HDHP). Usually, HDHP enrollment is a requirement |

|

Suppress Contribution Limits |

Whether to ignore the HSA Maximum Annual Contributions when calculating deductions for this employee. |

|

HSA PEO Match Override |

An HSA PEO Match Override amount if you want to override the match set at the system level in the back end. |

| 2. | Click Save. |

Defining Whether Account Balances Carry Forward

To determine whether a flexible spending account allows the employee to carry a positive balance forward at the end of a calendar year into the next year, use the Account Balances panel.

The Account Balances panel lists each Account selected in the Elections panel. It also displays the Funded Balance and the Elected Balance.

To define whether account balances carry forward to the next year:

| 1. | Complete the information as required in the Account Balances panel. |

| 2. | For each account, indicate whether the FSA account balance will Carry Forward into the next calendar year. |

| 3. | Click Save. |

Viewing FSA Activity

To list the vouchers that include deductions and reimbursements, use the Flexible Spending Account Activity panel.

Note: This information is for reference only.

To list deductions and reimbursements:

| 1. | Review the information that displays in the Flexible Spending Account Activity panel. |

| Column | Description |

|---|---|

| Voucher No. | The pay voucher where the transaction occurred. |

| Pay Date | The date on the pay voucher. |

| Account Type | The type of FSA account. |

| Account Description | The description of the FSA account. |

| Deduction | The deduction amount. |

| Reimbursement | The reimbursement amount. |

| Log No. | The FSA Log number for the reimbursed entry. |

| 2. | When finished, close the panel. |

Defining the Company Match

To define the company's annual match and view the match year-to-date amounts for the flexible spending account, use the Company Match panel. The Matched YTD is the amount paid by the company so far this year.

To define the company match:

| 1. | Complete the following information as required in the Company Match panel. |

| 2. | For each account, enter the company's Annual Match commitment to the employee. |

| 3. | Click Save. |